Unveiling the Evolution of Fintech:

A Journey from Convergence to Community – FTS.money

Author: Founder and CEO, Ajmal Samuel

The landscape of financial technology, commonly known as fintech, has undergone a remarkable evolution over the years.

What we recognise today as a fintech revolution traces its roots back to the early 21st century, marked by significant developments starting in the mid to late 2000s. During this era, a surge of innovative financial technology startups emerged, leveraging advancements in digital technology, data analytics, and evolving consumer preferences.

However, the seeds of fintech innovation were sown much earlier, with the advent of technologies like ATMs in the 1960s and online banking in the 1990s laying the groundwork for what was to come. The convergence of finance and technology gained prominence in the early 21st century, prompting the widespread use of the term “fintech” to describe the transformative impact on traditional financial services.

Financial technology startups have significantly transformed the banking experience by offering leaner, simpler, and more efficient consumer-focused solutions. This innovation has sparked a wave of digital transformation among financial institutions, compelling them to shift towards more consumer-driven products and services to remain competitive. Traditional financial services providers have realised the need to evolve from their reliance on conventional products and services.

Fintech companies have disrupted various sectors that were challenging for traditional players to change, especially those heavily focused on compliance. They have excelled in designing products and services using rich datasets and conducting in-depth consumer segmentation based on factors like income, savings, spending habits, age, and behavioural traits. Additionally, there has been a greater emphasis on customer-centric designs prioritising a satisfying customer experience, along with the introduction of new features like NFC and QR payments, cards, transactional wallets, Google Pay, Apple Pay, domestic wallets, Alternative Payment Methods and more. These payment solutions have significantly altered consumer behaviour, allowing individuals to access and use their money conveniently whenever and wherever they need it.

Alternative Payment Methods, or APMs, encompass diverse payment options in today’s payment landscape, offering consumers and businesses greater flexibility, security and convenience beyond traditional credit and debit card payments. The ecosystem of APMs primarily consists of:

Digital Wallets: Smartphone apps that store payment information and allow for quick, secure online and in-store transactions. Examples include Apple Pay, Google Wallet, and Samsung Pay. Digital wallets optimise the convenience of the consumer experience, eliminating the need to carry physical cards, with credit cards, debit cards or bank account information electronically stored on electronic devices.

Bank Transfers: Directly transferring funds from one bank account to another is a common APM. Such transactions include traditional bank transfers or modern systems like ACH (Automated Clearing House) or SEPA (Single Euro Payments Area) transfers in Europe. These transfers do not rely on physical cards to complete the transaction between sender and receiver.

Cryptocurrencies: Digital currencies such as Bitcoin, Ethereum, and other altcoins, have notably gained popularity in the last decade. These cryptocurrencies usually exist on decentralised networks built on blockchain technology and are often associated with higher security and lower transaction fees.

Buy Now, Pay Later (BNPL): Services like Afterpay, Klarna, and Affirm let consumers purchase items immediately and pay for them over time, usually with instalment plans. BNPL services are evolving as a popular choice for customers, with their ability to offer interest-free payments and credit-like services without requiring a credit card.

Prepaid Cards/eVouchers: These are reloadable and redeemable cards or eVouchers set with a fixed amount of money. These payment methods, like a debit or credit card, can be used as a payment, but are not linked to a bank account. Examples include gift cards and prepaid Visa/MasterCard options.

Mobile Payments: Mobile payments are digital transactions that take place on smartphones or other mobile devices for money transfers and payments. Mobile apps are commonly used to execute payments, with services like PayPal, Venmo, and Zelle offering easy, often instant, transfers of funds between individuals or businesses. Payment services can also take place via SMS, where transactions are initiated using text messages.

Digital Currencies: Beyond cryptocurrencies, this can include government-issued digital currencies or corporate loyalty points converted into payment methods.

Carrier Billing: Carrier Billing allows consumers to charge purchases directly to their mobile phone bill or deduct the amount from their prepaid balance. Commonly used for digital content like apps, games, and media, direct carrier billing is a simple and accessible online payment method available to consumers.

Direct Debit: This ‘pull’ payment method is recognised for its convenient and hassle-free payment experience. Ongoing payments for services or subscriptions are automatically collected directly from a consumer’s bank account, commonly used for utilities, subscriptions, and other recurring payments.

E-checks: Electronic checks that operate similarly to traditional paper checks but are processed in a digital format, providing faster and more efficient transactions. This method enables payments directly from users’ bank accounts.

In the context of global commerce, embracing APMs has become imperative and provides significant advantages. By offering customers flexibility and catering to regional payment preferences, APMs can enhance user experience and potentially increase conversion rates by providing a preferred and trusted payment option.

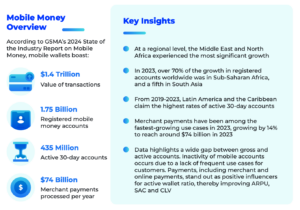

Amongst the popularity of APMs, mobile and smartphone penetration (specifically mobile wallets) has evolved as a successful medium for improving financial inclusion. According to GSMA’s 2024 State of the Industry Report on mobile money, Mobile wallets boast a $1.4 trillion value of transactions, 1.75 billion registered mobile money accounts, 435 million active 30-day accounts and $74 billion merchant payments processed per year.

Between 2020 and 2022, the global pandemic drastically changed consumer behaviour towards a preference for online shopping and digital payments, especially for food and groceries. The GSMA reported that mobile money transaction volumes grew faster than transaction values, reinforcing that Mobile money is being adopted with increasing frequency and for smaller transaction sizes across almost all use cases. These newfound high volumes of micro-payments and recurring use cases provided a much-needed boost to the adoption of digital payments, i.e., micropayments in developing economies.

One of the most significant use cases gaining considerable attention within financial institutions and fintech companies is within the payments industry. It remains pivotal for any financial institution in ensuring continued consumer engagement and activity while also yielding substantial benefits for economies by enabling businesses to provide more options for consumers, generate employment, and facilitate the economic circulation of money.

Nevertheless, it is apparent that the proliferation of diverse payment solutions was leading to a complex, time-consuming, and costly web of connections between fintech firms and financial institutions. Consequently, an urgent necessity emerged for a solution capable of consolidating various payment methods to deliver a unified and streamlined payment experience.

One such journey into fintech began in 2012 when a group of like-minded individuals identified significant opportunities in the payments sector. They embarked on a mission to build a unified payments platform, encompassing card payments acceptance, merchant onboarding and management, billing, settlements, and mobile payments, essentially the complete modern payments lifecycle. Unlike traditional setups where these technologies operated on separate platforms, their vision was to create a unified platform capable of consolidating and optimising converged payments.

After experiencing both successes and setbacks, their vision became clear, leading to the development of Octo3—a white-labeled converged payment platform delivered via cloud services. Octo3 swiftly gained momentum in the market, capturing the attention of prominent payment firms with its unified design and multi-tenant cloud-based architecture. Strategically based in Hong Kong, Octo3 evolved into a crucial hub and payment gateway infrastructure for international payment companies aiming to capitalise on Asian and South American alternative payment methods (APMs). Over time, Octo3 emerged as the preferred payment infrastructure provider for European payment companies looking to tap into the extensive range of alternative payment methods available in Asia. Beyond offering payment infrastructure and serving as an Asian payment methods nexus, Octo3 expanded its role to include regional payment aggregation services.

As the business expanded, new opportunities emerged from the infrastructure they had built:

- Provision of bank accounts and settlement services to their existing customers

- Demand for remittance services

- Transition to API-driven economies, necessitating an API Hub concept for accessing services

- Payment orchestration, intelligent global payment processing to vast payment networks

- Digital onboarding and KYC solutions, robust and secure compliance solutions

- ATM and Core banking infrastructure, modernisation of legacy systems with state-of-the-art solutions

- Enhanced APM aggregation to address the increasing prevalence of local and regional non-traditional payment methods

In 2023, acknowledging the changing needs of its clientele and emerging market trends, the company embarked on a transformative journey known as FTS.money (FTS). At the core of this transformation was the consolidation of Octo3 with the renowned banking technology solutions provider, Evantagesoft (EVS). Octo3 and EVS have taken the unprecedented move to merge their core products and services and extensive customer portfolios to form the new outfit FTS.Money. The two long-standing entities have strategically come together to leverage their financial and banking technology by provisioning a comprehensive suite of fintech solutions to address the dynamic financial landscape.

Their vision encompassed creating an ecosystem that provides an immersive experience for all relevant stakeholders. This diversified, resilient, continually evolving, and interconnected ecosystem offers each participant opportunities to gradually enhance their business propositions, delivering increased value to their customers.

This enablement is achieved with minimal effort, accelerated time-to-market, and cost-effectiveness for businesses, facilitated by the secure and robust architecture offered by FTS.money. Leveraging their existing products and services, mostly built as white-labeled infrastructure, FTS.money will provide the following products and services.

- API Hub for global financial service providers, including banks and payment companies

Provisioning an API Hub for global financial services providers, such as banks and payment companies, involves setting up a centralised platform that allows these organisations to create, manage, and integrate a variety of application programming interfaces (APIs). FTS.money’s API Hub will serve as a bridge between different financial systems, enabling seamless and secure data sharing and transaction processing across various platforms and geographic locations.

Provisioning an API Hub will enable global financial service providers to offer more responsive, innovative, and secure customer services, fostering international growth and collaboration in the financial sector.

- White Label Core Banking for MFIs and Credit Unions with a Hosted Model

Provisioning a cloud-based, white-labeled core banking and payments infrastructure for MFIs and Credit Unions involves deploying a scalable and flexible digital banking system that these financial institutions can customise and brand as their own. This solution leverages cloud technology to offer a comprehensive suite of banking functions and payment processing capabilities tailored to meet the specific needs of different financial service providers.

By adopting FTS.money’s cloud-based, white-labeled infrastructure, financial institutions can efficiently provide robust, secure, and customisable banking solutions. This approach drives innovation and enhances their ability to serve customers effectively while significantly reducing technology and infrastructure costs.

- Payment orchestration

At FTS.money, we offer payment orchestration services that ensure the seamless management and coordination of various payment processes and systems within a single unified platform. This is particularly important for businesses handling multiple payment methods, gateway providers, and financial services, as it simplifies the complexities involved in financial transactions.

By adopting FTS.money’s payment orchestration, businesses can enhance their payment processes, reduce operational complexity, improve transaction success rates, and offer their customers a smoother, more reliable payment experience. This leads to increased customer satisfaction and potentially higher revenue due to fewer payment-related issues.

- Crypto acceptance payment gateway

FTS.money currently offers a crypto acceptance payment gateway that enables businesses to accept payments in cryptocurrencies like Bitcoin, Ethereum, and others. This gateway facilitates seamless and secure transactions of digital currencies, allowing customers to pay with their preferred cryptocurrency while providing businesses with reliable methods to process these payments.

By implementing FTS.money’s crypto acceptance payment gateway, businesses can tap into the growing market of cryptocurrency users, enhance their payment flexibility, expand their customer base, and stay ahead in the rapidly evolving digital economy.

- Virtual IBAN issuing and expedited settlements

FTS.money offers virtual IBAN issuing and expedited settlements to enhance international payment processes for businesses. A Virtual International Bank Account Number (IBAN) functions like a traditional IBAN but is not tied to a physical bank account. Instead, it is linked to a primary account, usually managed by a banking or financial service provider. Expedited settlements refer to the faster processing and clearing of financial transactions, ensuring that funds are transferred and available more quickly than traditional methods.

Together, FTS.money’s virtual IBAN issuing and expedited settlements provide businesses with advanced tools to streamline their international payment processes, enhance cash flow efficiency, and improve overall financial management. These services are especially beneficial in today’s globalised economy, where speed and precision in financial transactions are critical for maintaining a competitive advantage.

- Global remittance platform

A global remittance platform is a digital service designed to facilitate the transfer of money across international borders. This platform will provide businesses with an efficient and cost-effective way to send and receive funds globally.

Our global remittance platform will be able to streamline the process of sending and receiving money internationally, offering speed, security, and cost savings. This is crucial for fostering global connectivity and providing financial support across borders.

- Cloud-based White-labeled ATM infrastructure

Cloud-based white-labeled ATM infrastructure is a service model that provides financial institutions with the necessary backend systems and software to operate and manage automated teller machines (ATMs) under their own brand but without the need to develop or maintain the underlying technology themselves. Our cloud-based white-labeled ATM infrastructure will enable financial institutions to provide branded, scalable, and secure ATM services efficiently and cost-effectively, leveraging the benefits of cloud technology and outsourcing the complexities of system management.

- Global payments switching

FTS.money currently offers global payments switching, a system that facilitates the routing and processing of payment transactions across different networks, payment processors, and financial institutions worldwide. This technology ensures that transactions are directed through the most efficient and cost-effective paths, enabling seamless and interoperable global payments.

FTS.money’s global payments switching provides crucial infrastructure for efficient, secure, and cost-effective transaction routing across international payment networks, enabling e-commerce businesses, multinational corporations, and financial institutions to manage global payments with greater ease and reliability.

- Digital banking platforms and wallets

Digital banking platforms and wallets are modern financial technologies that provide users with convenient, flexible, and secure ways to manage their money electronically. Digital banking platforms are comprehensive online systems that allow customers to conduct a wide range of banking activities without needing to visit a physical bank branch. Digital wallets, also known as e-wallets, are applications that store users’ payment information securely and enable them to make transactions electronically without the need for physical cards. Our digital banking platforms and wallets represent the evolution of traditional banking and payment systems, leveraging technology to offer enhanced convenience, security, and functionality for managing money digitally.

- E-vouchering solutions

E-vouchering solutions refer to digital systems that issue, manage, and redeem electronic vouchers or coupons. These solutions are utilised across various industries to provide discounts, promotions, and financial aid to customers or recipients through a streamlined, secure, and efficient electronic format. Our e-vouchering solutions will transform the traditional voucher system into a modern, digital format, offering a variety of benefits such as cost efficiency, instant delivery, and enhanced security while ensuring a seamless experience for both issuers and recipients.

- Digital KYC and onboarding solutions

Digital KYC (Know Your Customer) and onboarding solutions are technologies that enable businesses to verify the identity of customers remotely, streamline the onboarding process, and comply with regulatory requirements. Our digital KYC and onboarding solutions streamline customer verification processes, enhance compliance, and improve the overall onboarding experience for businesses and customers alike.

Secure transaction processing and comprehensive financial analytics will ensure robust and adaptable solutions for the growing market demands. FTS.money also boasts state-of-the-art security measures and a Fintech Factory operating round the clock to introduce new products and services aligned with FTS.money’s strategy, customer feedback, and market demands. By swiftly adapting to the rapidly evolving global payments landscape, FTS.money ensures its clients remain updated with the latest advancements in technology, enabling them to focus more on their business while staying competitive in the market.

In essence, the journey from convergence to community epitomises the transformative power of fintech, where innovation and collaboration converge to redefine the future of financial services.